Manchin gangs up with Republicans to end critical help to American families

“It’s going to be hard next month, and just thinking about it, it really makes me want to bite my nails to the quick,” Anna Lara told The New York Times in December. She’s talking about the end of the monthly Child Tax Credit payments; the last payment went out on December 15. She’s a mother of two young children and she lives in Huntington, West Virginia. “Honestly, it’s going to be scary. It’s going to be hard going back to not having it.”

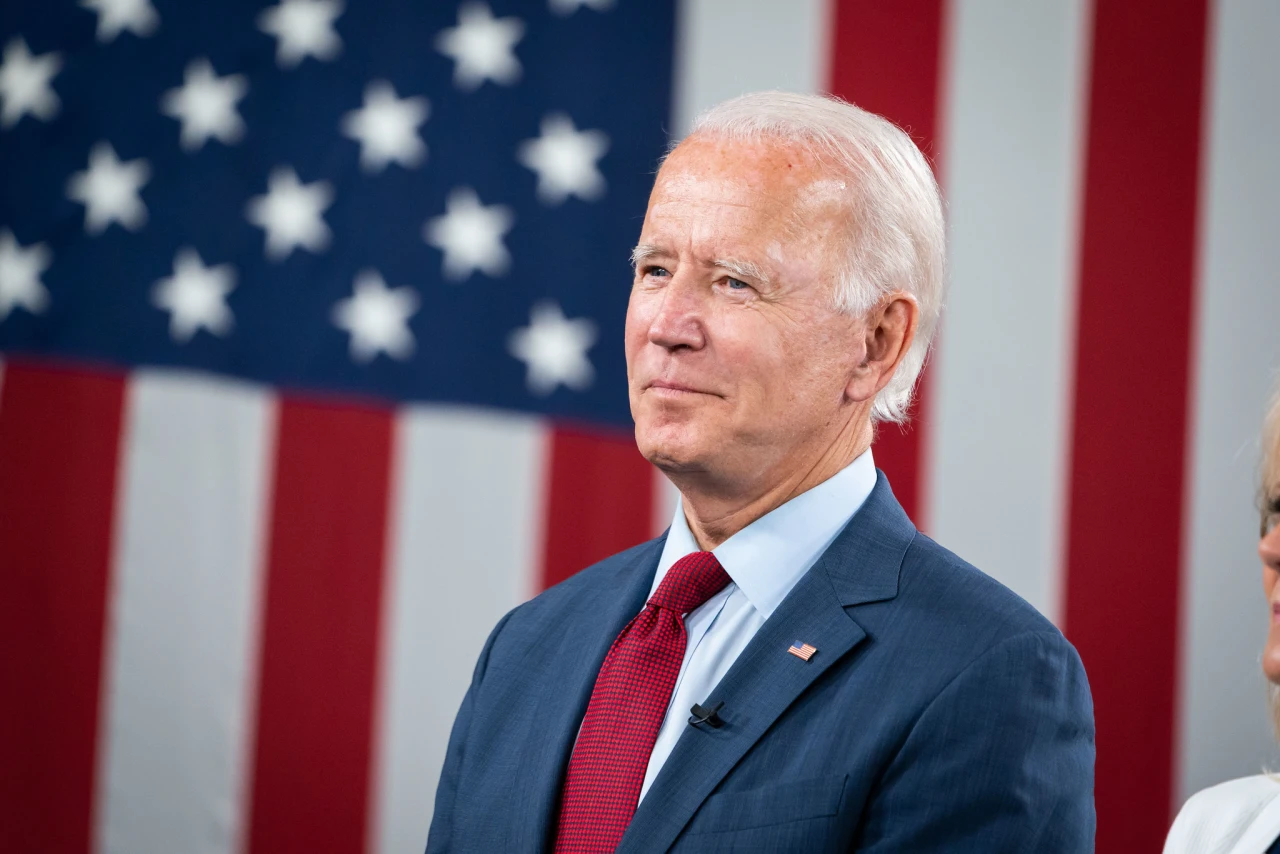

It’s her senator, Democrat Joe Manchin, who has given Senate Republicans an assist in blocking President Joe Biden’s Build Back Better plan, and the extension of those monthly payments. Manchin has privately told colleagues that he’s opposed to those payments because he believes parents will spend the money on drugs instead of on their children. “Your children watch you, and if you worry, they catch on to that,” Lara said. “With that extra cushion, we didn’t have to worry all the time.” The money has helped her family since she lost her job in the pandemic and hasn’t been able to return to work because of the cost of childcare. Her partner still has his job, but the payments have helped them meet all their living expenses—replacing a broken appliance, car repairs, a new car seat for their 6-year old, and new shoes. Not illegal drugs.

Campaign Action

According to nonpartisan, independent research from the Center on Poverty & Social Policy at Columbia University, the payments kept 3.8 million out of poverty in November of 2021. In just that month, the families of 61.3 million children received the payments. That resulted in a nearly 30% reduction in poverty rates compared to the level they estimate in the absence of the payments.

The credit was temporarily expanded and extended in the American Rescue Plan signed into law by President Biden last spring, but Congress and Biden intended to make the program permanent and included it in the Build Back Better plan. The payments were increased from the previous maximum of $2,000 annually per child to $3,600 annually for children up to age 5, and $3,000 for older children. The other change was to make those payments monthly, instead of coming in one payment after families file their tax returns. It also expanded the program to people who hadn’t been able to get the full credit because they had too little income. That’s what’s really helping reduce poverty among children—about 1/3 of the nation’s kids (half of Black and Hispanic children and 70% of kids with single parents) previously didn’t qualify for the full credit.

“What we’ve seen with the child tax credit is a policy success story that was unfolding, but it’s a success story that we risk stopping in its tracks just as it was getting started,” Megan Curran, director of policy at Columbia’s Center on Poverty and Social Policy, told the Times. “The weight of the evidence is clear here in terms of what the policy is doing. It’s reducing child poverty and food insufficiency.”

Another argument against the policy has been that it would discourage work, but there’s been no evidence of that happening, either. In fact, says Samuel Hammond, director of poverty and welfare policy at the Niskanen Center, it is probably encouraging more parents to work because they can more easily afford child care. “There’s every reason to believe that in the current labor market, the child tax credit is work-enabling, and no evidence to the contrary has been presented,” he told the Times. He wrote a report last summer estimating the expanded payments would create the equivalent of 500,000 full-time jobs and provide $27 billion in increased consumer spending.

That doesn’t mean it’s contributing to inflation, one economist says, as Manchin and Republicans have argued. “That’s a noninflationary program,” said Joe Brusuelas, chief economist at the accounting firm RSM. “That’s dedicated toward necessities, not luxuries.” Or illegal drugs.

As of now, Manchin is still demanding that either a further income limit is placed on the child tax credits, or the provision is removed entirely. The CTC does already have income limits for 2021 filers, starting at above $150,000 for joint filers, $112,500 for heads of household, and $75,000 for single filers—and no, it makes no sense for single parents to be penalized with that lower-income threshold. Those limits were higher under the Rescue Plan, phasing out at $200,000 and $400,000 levels are where the child tax credit phases out faster for individual or joint tax filers.

Nonetheless, and probably because he hasn’t done his homework to know already that the CTC is means-tested, Manchin wants it to be limited. He’s also said maybe there should be work requirements, a Dickensian solution at any time but particularly with COVID-19 resurging and the omicron variant taking hold.

Also, the omicron variant is causing a massive COVID surge, and schools and businesses are going to start closing again and heating bills in much of the country are going to rise and the monthly CTC payments have ended. None of which Manchin gives a genuine shit about. Never mind that 181,000 West Virginia families got their final monthly checks last month. The checks averaged $446 and reached 305,000 children. That’s 93% of the state’s children, 50,000 of whom are at risk of their families falling into poverty if the program isn’t resumed.

Among them is Anna Lara’s family. “Right now, both of my vehicles need gas and I can’t put gas in the car,” she told the Times. “But it’s OK, because I’ve got groceries in the house and the kids can play outside.” At least it was okay in December.