Manchin keeps arguing Build Back Better will lead to more inflation. Manchin is wrong

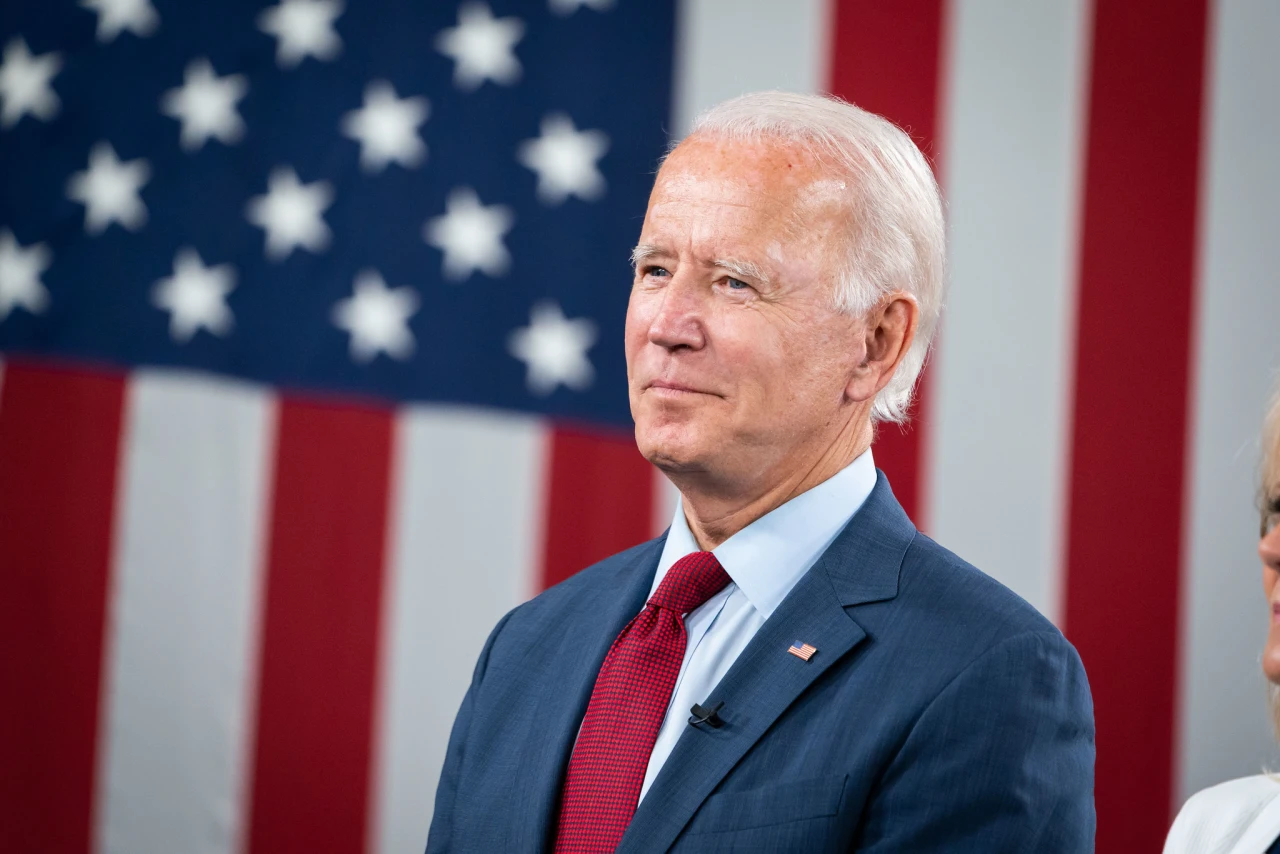

The announcement last week from the Bureau of Labor Statistics that consumer prices rose 6.2 percent over the past year in the U.S. The pain American consumers feel is very real (though their reported milk consumption might be exaggerated), and does pose a real political challenge to President Joe Biden and congressional Democrats if it lasts well into next year.

That’s all very true. But how it’s being reported and how it’s being used by the traditional media are problematic. While the larger stories of the complexities of grocery store monopolies and how dairy farming and cattle ranching and meat production are manipulated are reported, the policy side of it is reduced to simple politics. And to this, fueling Sen. Joe Manchin’s ill-informed and stubborn opposition to President Biden’s Build Back Better plan on the basis of inflation.

Like this:

Pretty much every reputable economist (plus Larry Summers) is in agreement that this period of inflation is transitory, albeit more persistent than originally assumed, and that the way to deal with it is to get the COVID-19 pandemic under control and then support the still-recovering economy with the boost from BBB. That’s what 17 Nobel laureates in economics, including Joseph Stiglitz, have argued. The investments in BBB, they assert, will increase “the ability of more Americans to participate productively in the economy, helping to improve our low employment-working age population ratio.”

Because the bill is financed by tax increases, they argued that “the inflationary impacts will be at most negligible—over the medium term outweighed by the supply-side benefits; and their progressivity will help address one of the country’s critical problems, the growing economic divide.”

Harvard Economist Jason Fruman points out that even for those (like Summers) how have argued that the current inflation has stemmed from the $2 trillion in COVID relief overheating the economy—the theory Manchin seems to have bought into—there’s really no basis for comparison. The COVID relief was pumped into the economy all at once; the money from Build Back Better with few exceptions won’t start reaching people until this inflationary period is likely over—it’s spent over one and five and 10 years. University of Chicago economist Austan Goolsbee predicts that inflation is “a short-run phenomenon,” and that “The fiscal impulse from the reconciliation bill in the next six to 18 months wouldn’t be that big.”

Furman argues that universal pre-K and paid family leave will be drivers in reducing inflation, by increasing the workforce and productive capacity. This year’s annual survey from Care.com found that “85% of parents, compared to only 72% in 2020, report they are spending 10% or more of their household income on child care,” and that “94% of parents have used at least one major cost-saving strategy to save money on child care in the past year, including reducing hours at work (42%), changing jobs (26%), or leaving the workforce completely (26%).” That’s a quarter of respondents saying they quit working because they couldn’t afford child care. It’s a crisis heightened by the pandemic, but by no means over.

There’s also the part about how this bill will actually be paid for by raising taxes. “Something that you raise taxes to pay for,” Goolsbee said, “doesn’t really have that strong a stimulative effect.” As currently written, though that might not last, the bill actually hikes taxes for rich people and cuts taxes for everyone else. That’s according to a new analysis from the Tax Policy Center.

People who make about $885,000 or more—the top 1%—would pay about $55,000 more than they currently do, and the top 0.1% would pay nearly 6% more than under current law. Those are the people making $4 million and more, who would pay and additional $585,000 annually, on average. It also increases corporate taxes to the tune of $830 billion. That could be one of Manchin’s true motivators in derailing the bill, which would be really ironic.

Because, as the Wall Street Journal reports, a whole lot of inflation is happening on purpose because some of the biggest U.S. companies are “seizing a once in a generation opportunity to raise prices to match and in some cases outpace their own higher expenses, after decades of grinding down costs and prices.”

“Nearly two out of three of the biggest U.S. publicly traded companies have reported fatter profit margins so far this year than they did over the same stretch of 2019, before the Covid-19 outbreak, data from FactSet show,” the WSJ reports. How fortunate for them. Glenn Richter, the chief financial officer of International Flavors & Fragrances, a supplier to big food companies, admitted that his company is exploiting the situation, because as the WSJ explains, “Widespread inflation makes it easier to broach the topic of raising prices with customers.”

If anything is going to drive inflation, it’s corporate greed. “The risk to the economy is that price hikes not only stick, but convince customers more increases are inevitable, spurring inflationary demand and sparking a vicious cycle,” says the WSJ. The best way to combat that, other than taxing the hell out of them, is with the kinds of investments in people that BBB represents.

And to get there, it’s key to understand why we’re experiencing inflation—pent-up demand, supply-chain problems, labor shortages, and corporate greed—and address them. Passing this bill could also help solve those political problems.