As House prepares to pass Build Back Better, making the tax provisions fairer is up to the Senate

The legal of the former guy just keep hanging over Capitol Hill like a huge cloud of toxic hot air. It’s not just the lingering fear from Jan. 6 and violent threats from Republicans, it’s the remnants of their punitive policies.

Case in point, the current problems—and infighting—Democrats are having over taxes and what to do about the cap on state and local tax (SALT) deductions, the provision in the 2017 tax scam that was intended specifically to punish people living in blue states. That law capped the SALT deductions at $10,000; there was previously no limit on the deduction, subject to the individual alternative minimum tax). Yes, it punished high-income taxpayers, but it also anyone who lives in a state that likes to adequately fund public services and schools, and where housing costs and property taxes are particularly high.

It worked. About 11 million filers ended up paying a lot more in taxes. That’s how Trump and team financed their big corporate and high-income tax cuts. Hunter nailed the intent:

It’s a bonus for them that it has tied Democrats in knots trying to figure out how to unpick it.

The House bill sets an $80,000 cap that would last through 2030, then reduce to $10,000 for one year, and then expire altogether, a provision the Sabotage Squad of conservative Democrats insisted upon. The 2017 tax law would expire after 2025. It’s hard to argue that that isn’t a windfall for the wealthiest taxpayers. That’s the case Sen. Bernie Sanders makes. “You can’t be a political party that talks about demanding the wealthy pay their fair share of taxes and then end up with a bill that gives large tax breaks to many millionaires,” said Sen. Bernie Sanders told Politico. “You can’t do that. The hypocrisy is too strong. It’s bad policy, it’s bad politics.”

On the other hand, “Its intent was to penalize blue states—I’m not going to let them get away with that,” said Rep. Gregory Meeks, New York. “I look at my homeowners in my district and how they’ve been devastated as a result of a $10,000 SALT cap, it hurts them in a very big way.” That’s real. But not so much an issue in 2022, or 2024, battleground states, where Republicans are going to troll, hard.

Look at this asshole, for example. “It’s foolish … if you look at the amount of money they are going to give to rich people, it’s staggering,” said National Republican Senatorial Committee Chair Rick Scott. “I’m going to make sure that in all of our states that everybody knows what [Democrats] are doing.” The Florida Republican is also the guy who calls the pain Americans are feeling right now because of inflation “a gold mine” for Republicans. Yes, it’s hypocritical and deplorable, but that’s what Republicans do. They’ll play the class war car every chance they get, and count on the traditional media to not remind the country that the GOP tax scam has deepened income inequality, and gave the super-rich an absolute windfall in the pandemic.

The House bill does give the wealthy a big break. The Center on Budget and Policy Priorities has crunched the numbers, determining that it would “provide wholly unnecessary tax cuts of up to $25,900 to many of the country’s richest people.” While the bill also includes a surtax on adjusted gross incomes for very wealthy people, it only applies to those making more than $10 million. So the slightly less very wealthy person making $9 million would get as much as that $25,900 tax cut. Not great.

Nearly 80% of households that make between $500,000 and $1 million would get a tax cut averaging $8,800 under the House bill, along with 70% of those in the $1 million-plus range, who would see a cut averaging $16,960, according to the Tax Policy Center.

The bill still would tax the rich, through that 5% surcharge for $10 million-plus earners with an additional 3% for those making more than $25 million, the top 0.02%. The bill would also set a 28% rate on long-term capital gains and dividends, up from 20%. It gives $79 billion in new funding to the IRS so it can go after the cheaters—the top 1% who evade as much as $160 billion annually.

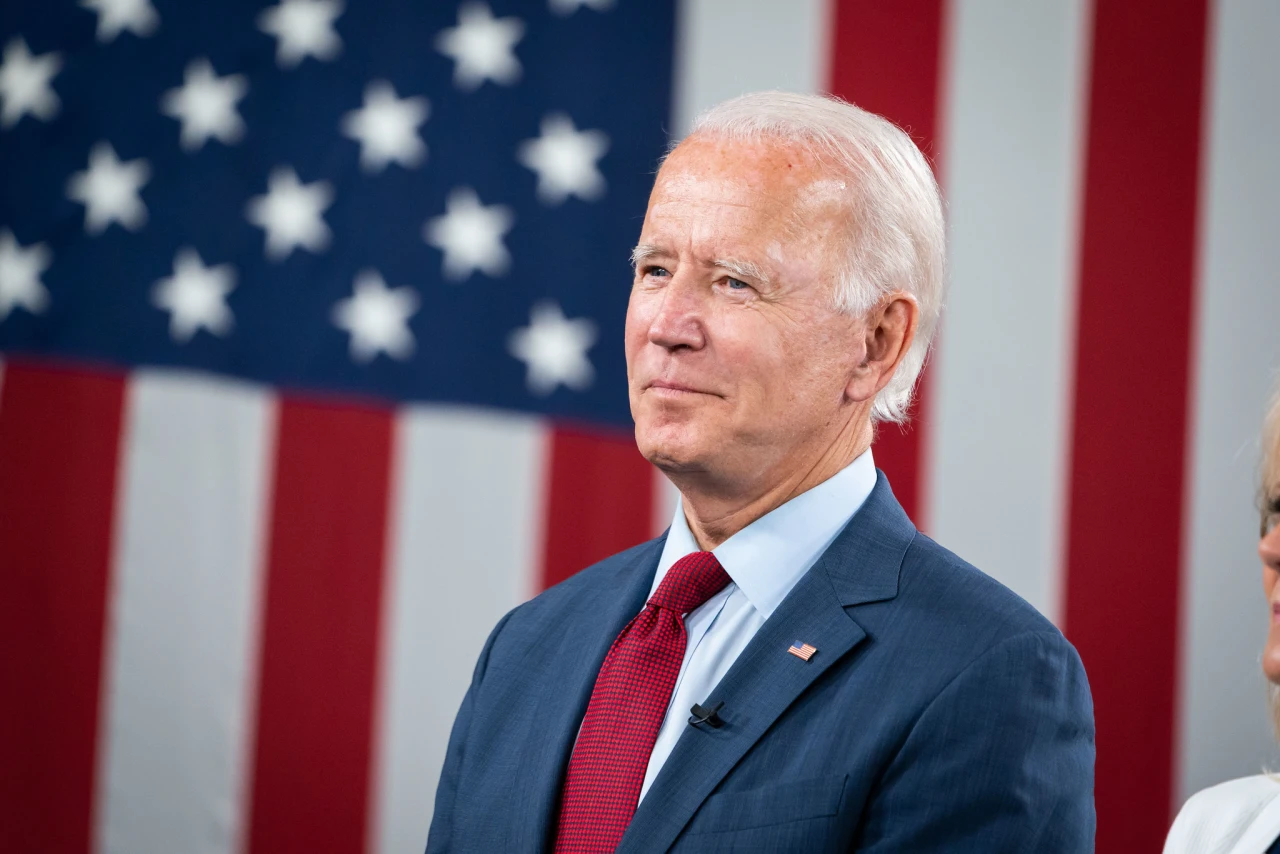

Sanders and a fellow Democrat, Sen. Bob Menendez of New Jersey, have their own proposal—a much more fair one. They’d keep the cap at $10,000, but exempt people under a certain income threshold—Sanders has proposed $400,000 since that’s the level President Joe Biden set in his pledge to not raise taxes on any but the rich. In some of the nation’s most expensive cities, $400,000 is a lot of money, but it’s not super-rich.

Many Senate Democrats prefer the Sanders-Menendez approach. “I’m not worried about the perception that we’re doing too much for wealthy people. I’m worried that we may do too much for wealthy people. It’s the reality that troubles me,” said Sen. Elizabeth Warren of Massachusetts. “I’m not here to help those at the top.”