Reagan used reconciliation to put America on a 40-year road to ruin. Biden can start the repairs

On right-wing media, the idea that Democrats might use the reconciliation to push through a funding bill that includes steps to clean up IRS enforcement and hike taxes on corporations currently paying absolutely nothing is being greeted as the ultimate horror. But every claim that Democrats are “misusing” the ability to pass a reconciliation bill that can, with a simple majority, alter taxes for the wealthy, is ignoring one big point: As NPR reports, the giant hole America has dug under the middle class was excavated using exactly this process when, “President Ronald Reagan used reconciliation to achieve his ‘revolution’ in federal fiscal policy in 1981.”

There’s a reason that when discussing issues like the growing gap in wealth between the richest and poorest Americans, and in particular the massive expansion in the gulf between what corporate CEOs make and what an average worker takes home, the charts almost invariably start with the 1980s. That’s because it was Reagan’s policies that really injected rocket fuel into this inequality. It was a change that rewarded not hard work, but wealth accumulation. And wealth … has accumulated.

That 1981 change also greatly increased the opportunities and incentives to escape taxes in another way: cheating. Most Americans have little choice about paying their income taxes because their income is all reported on W-2s or similar forms. For the wealthy, this isn’t true. That leaves open the possibility of simply underreporting income, or lying about investments, in order to evade taxes. Which they have done … to the tune of $7 trillion over the last decade.

The law already provides the wealthy with numerous options for tax avoidance—legally getting around paying what they might have normally owed. That’s not what’s going on here. When Biden talks about beefing up IRS enforcement, this isn’t a matter of closing loopholes and taking out provisions, even questionable provisions, that allow taxes to be avoided. This is tax evasion—illegally dodging tax payments by hiding income or falsely claiming deductions that don’t exist.

To put it more simply, the wealthy have cheated America out of enough money in the last 10 years that the whole nation could have run for more than a year and a half just on the amount they stole. That Republicans are coming down against policing this grandest of grand larceny should be all anyone needs to know about the “law and order” party.

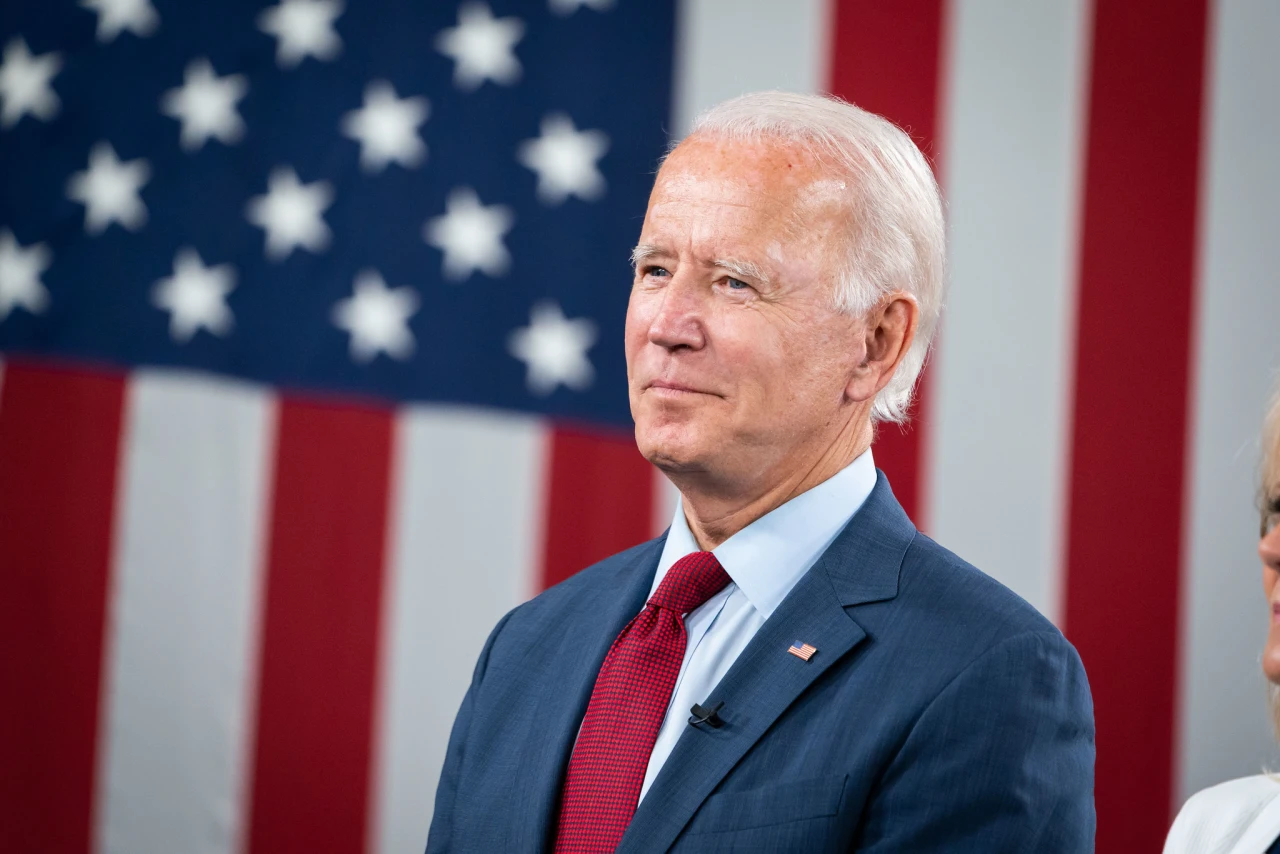

If President Joe Biden’s bill actually cost $3.5 trillion, which it doesn’t, the whole thing could be paid for—and then some—simply by getting the wealthy to pay what they already owe. But the bill also includes higher tax rates for the wealthiest Americans as well as closing some of the gaps that the largest corporations in the nation have used to pay $0 in taxes.

Republicans may still be beating their chest over the idea of raising taxes, but a whole series of polls show that there is broad public support for this action. In June, Morning Consult reported that 58% of Americans backed higher taxes on the wealthy and corporations. Gallup summarized their findings, which have put a majority of America in favor of higher taxes since 2018. And following Biden’s election, The New York Times found that 67% of Americans favor raising taxes on those making over $400,000—exactly the cutoff that Biden has set.

As that NPR story makes clear, there’s a growing realization—not just among academics and economists, but in the general public—that the policies that Republicans foisted on the nation under Reagan, and accelerated under both Bush and Trump, have been instrumental in creating a hugely lopsided economy. Republicans sold the idea of lowering taxes as a “moral” issue, spreading a mythology that people simply would not work if they couldn’t take home unlimited wealth. It was part of the same propaganda effort that rebranded employers as “job creators.” In this mythology, the lives and incomes of the vast majority of Americans are dependent on the visionary genius of a hard-working few, and unless those few were given all the money, well … Atlas just might shrug.

After 40 years of living under a system where the extremely wealthy pay rates that are often less than the middle class (and that’s even when they’re not cheating), it’s hard to recall just how things worked over a generation ago. But the system that has created a nation where a handful of people own as much as a majority of the population put together didn’t come from minor tinkering.

The “Reagan Revolution” might have stopped short of actually storming the Capitol, but it was an overthrow of the fiscal policies that turned the United States from an isolated backwater into the most successful nation on the planet. Somehow, in the name of patriotism and innovation, Republicans sold the idea that the system that had created everything from the light bulb to the Apollo program had to be undone. And they’ve kept on selling that idea for four decades, with much of the media going along for the ride.

What’s happened since that first bill passed has been a whole series of changes in the tax code, but almost all of them were designed to give more to the wealthy and corporations. They got lower rates. Then lower rates. Then lower rates. Then still lower rates. And at the same time they got more loopholes providing more ways to create legal tax avoidance. Not coincidentally, there’s also been a decrease in the IRS’ ability to audit and enforce tax laws, leaving more room for that $163 billion-a-year level of tax cheating.

Making all the changes required to undo 40 years worth of wrecking the tax code won’t be easy. In fact, it’s likely to be impossible. But if Democrats manage to get through a bill that at least starts to address the damage that’s been done … well, it will be a start.

And if they use reconciliation to make it happen, there will be a level of justice in that move.