Private colleges aren't the only places leaving students with serious student loan debt—I would know

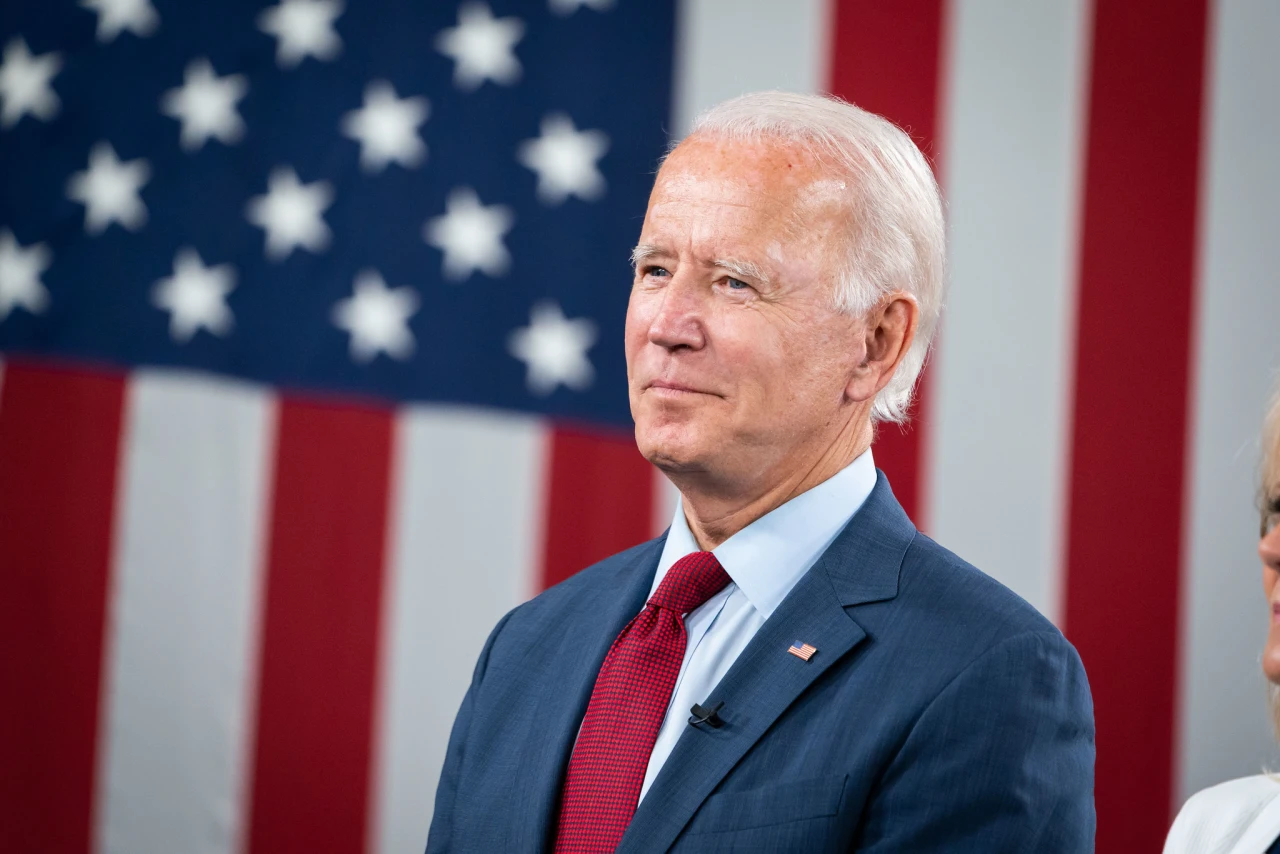

Talking about student debt and talking about the cost of college are topics that generally go hand-in-hand. While some progressives, like Sen. Bernie Sanders, argued on behalf of eliminating all student debt, period, others in the Democratic Party, like President Joe Biden, have taken up a much more conservative stance: forgiving up to $10,000 in federal student loans per borrower.

State colleges and universities play a funny role in this dialogue. Whenever the cost of college or student debt comes up, someone—on any side of the political aisle—will inevitably posit about why someone didn’t go to a public school. We all know private schools have higher tuition, after all. So why not just graduate debt-free by going public? I myself went to an in-state, public college, received an academic grant and federal financial aid—and I, myself, am still paying back my student loans.

Growing up low-income (think: public housing and food assistance in the form of EBT and free lunches), college was a particularly abstract idea for me. No one in my immediate family had gone to college, and in fact, not everyone had graduated from high school. I grew up in Massachusetts and was lucky to benefit from some truly great public school systems. Based on family income, I qualified for a fee waiver for the SAT as well as some college applications. All, truly, great opportunities.

My guidance counselor and teachers pushed hard on going to private school. In the end, I simply could not afford it, as the schools I was looking at no longer offered a “full-ride” to any accepted student and my family did not qualify to co-sign the loans I would have needed to make up for my aid package. I appealed at the college I most wanted to go to, and in spite of its strong reputation, long history, and enormous endowments, I was gently told that this situation happened all the time and that state schools in the area would still let me enroll, even though I’d technically missed the deadline. That aid administrator was, thankfully for me, correct.

I went to a local state college at the last minute (so last-minute I was lucky to get a dorm spot on campus) where my financial aid package did cover my entire cost of attendance—but that aid package included federal loans, both subsidized and unsubsidized. I lived on campus all four years of undergrad because my family’s living situation was chronically unstable; to offset the cost in part, I became a resident assistant, which gave me a discount on housing and paid a yearly stipend. I worked that role plus two on-campus jobs while attending school full-time because if I wasn’t full-time, it would have negatively affected my aid package.

And I still have loans.

No one in my life suggested community college. No one suggested attending school part-time. No one suggested a trade school. No one suggested looking into union jobs popular in the area, like Teamsters. As an adult, I know it’s easy to immediately think: Well, live your life! You can’t do things or not do them because someone else put the idea into your head. And that’s true.

But many people—like myself—are making these decisions before we’re old enough to vote, buy cigarettes, buy alcohol, or get married (in most states, anyway). While young people obviously have a range of lived experiences, it’s fair to say few people are going to advise a newly 18-year-old to take on a mortgage just because they somehow qualify for it. So why is it so common to encourage them to take on student loans?

If I hadn’t have gone to college, my plan was to continue working as a cashier at a chain pharmacy in my hometown. I’d held that job for about two years, and before that, worked as a cashier at a fast-food restaurant. I felt seriously lucky to have gotten the pharmacy job, as it paid more than the other and I didn’t leave work smelling like grease. There is nothing wrong with those jobs, and nothing wrong if I had stayed in them. But staying in them likely would have kept me in the cycle of poverty I grew up in. The choice for so many students like me? You can break the cycle—but you’ve got to take on debt.

Of course, I’d be remiss to talk about debt without acknowledging that some schools do, in fact, give full packages. Some schools will cover every last cent, including books. If you are chronically low-income, those opportunities are far from easy to access—if your family can’t afford, for example, to put you into club sports, SAT prep classes, or foreign language camps, you may not be as desirable or competitive an applicant as someone else. If your grades simply aren’t good enough—mine likely were not—because you were tired from work, or from emotional stress, or because you were young and figuring yourself out, you may not be up to snuff to get those kinds of rare deals. This isn’t to say people who get these packages don’t deserve them—they do. But simply working hard enough or being “smart enough” to get a full-ride intersects more with class, race, and privilege than many people want to acknowledge.

I know reading about anyone’s personal experiences is not representative of the whole. That’s okay. Given that money is still such a taboo in this country, it feels a little strange even writing openly about how I afforded college, and the fact that I still have student debt, in spite of being lucky enough to have a full-time job. But I do. And when people—from folks on Twitter, to elected officials, to activists, to those advising teenagers in their life about college—talk about the “worth” of college and how to wrangle with affordability, I don’t think our standard conversations and media coverage do enough to tell stories like mine.

You can make “smart,” strategic choices to avoid debt. You can take on less debt than if you’d gone somewhere else. You can work hard. You can try hard. But education in this country—even public education—is simply not affordable the way it used to be, and for historically low-income students, the burden is simply unjust.