Finally, some student loan news to celebrate

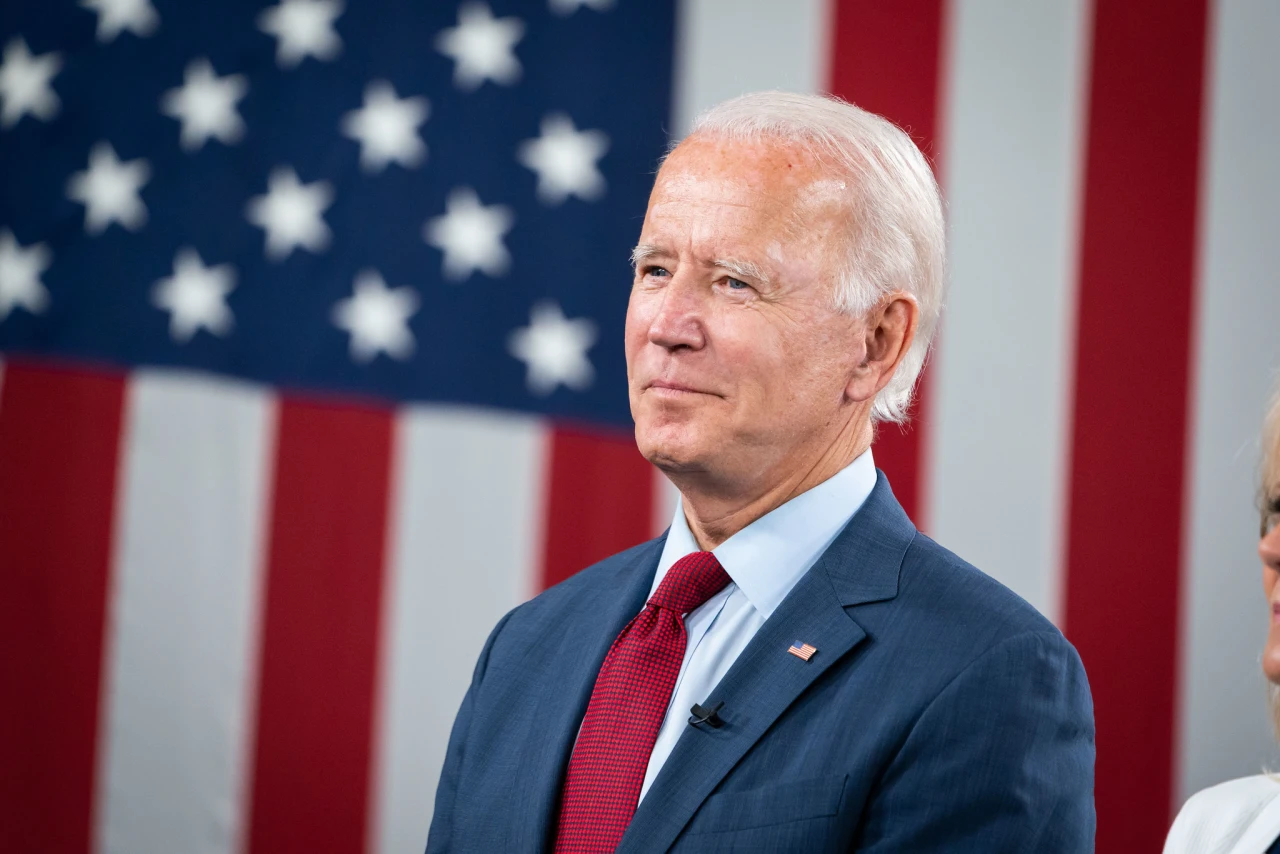

I am one of the first to admit frustration and disappointment when it comes to student loan relief. We heard from Sens. Bernie Sanders and Elizabeth Warren about their sweeping but feasible plans to cancel—or at least reduce—the serious burden of student debt on the campaign trail. Amid the pandemic, Donald Trump did, technically, do a good thing by pausing payments and collections on federally-held student loans. Since entering office, President Joe Biden has extended that pause twice, most recently continuing it through January 2022.

Our latest update from the Biden administration frustrated many with its specification that it would be the “final” extension as the nation still faces a pandemic, and we still have not seen the promised $10,000 in relief the president campaigned on. But today, there is some absolutely excellent student loan news to celebrate. On Thursday, the Biden administration announced more than 300,000 borrowers will receive automatic federal student loan forgiveness.

The Education Department announced that more than 323,000 borrowers determined to have a total and permanent disability (TPD) by the Social Security Administration (SSA) would have their federal loans forgiven automatically. This totals to about $5.8 billion. The change goes into effect in September.

As of now, federal law allows borrowers with TPDs to apply for loan forgiveness under the rationale that they will not be able to pay them off due to their inability to earn an adequate income. In the past, borrowers had to apply to have their loans forgiven. Instead, now, student loan servicers will match customer information with the SSA to cut out the application process.

How does this work in practice? Many people who live with TPDs also receive Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), so the SSA would have their information. And it’s the SSA who decides if borrowers ultimately qualify. Smooth process, right?

The federal government plans to phase out the current program’s three-year monitoring period, which essentially serves to make sure borrowers’ income continued to meet forgiveness requirements. If it doesn’t, borrowers could have their loans reinstated.

“We’ve heard loud and clear from borrowers with disabilities and advocates about the need for this change, and we are excited to follow through on it,” U.S. Secretary of Education Miguel Cardona said in a statement. “This change reduces red tape with the aim of making processes as simple as possible for borrowers who need support.”

These important changes are due to the work of advocates who have been rallying on behalf of those who cannot work and are saddled by federal student loan debt. For years, advocates have expressed frustration and confusion at the forgiveness application process, including the knowledge gap of borrowers who aren’t even aware they’re eligible, let alone that such relief existed.

The Biden administration is doing right by vulnerable folks who more than deserve the relief. Let’s hope this is a big step in the right direction as we fight to whittle down student debt and alleviate the burden of so many in this country, and especially low-income folks, women, and people of color.