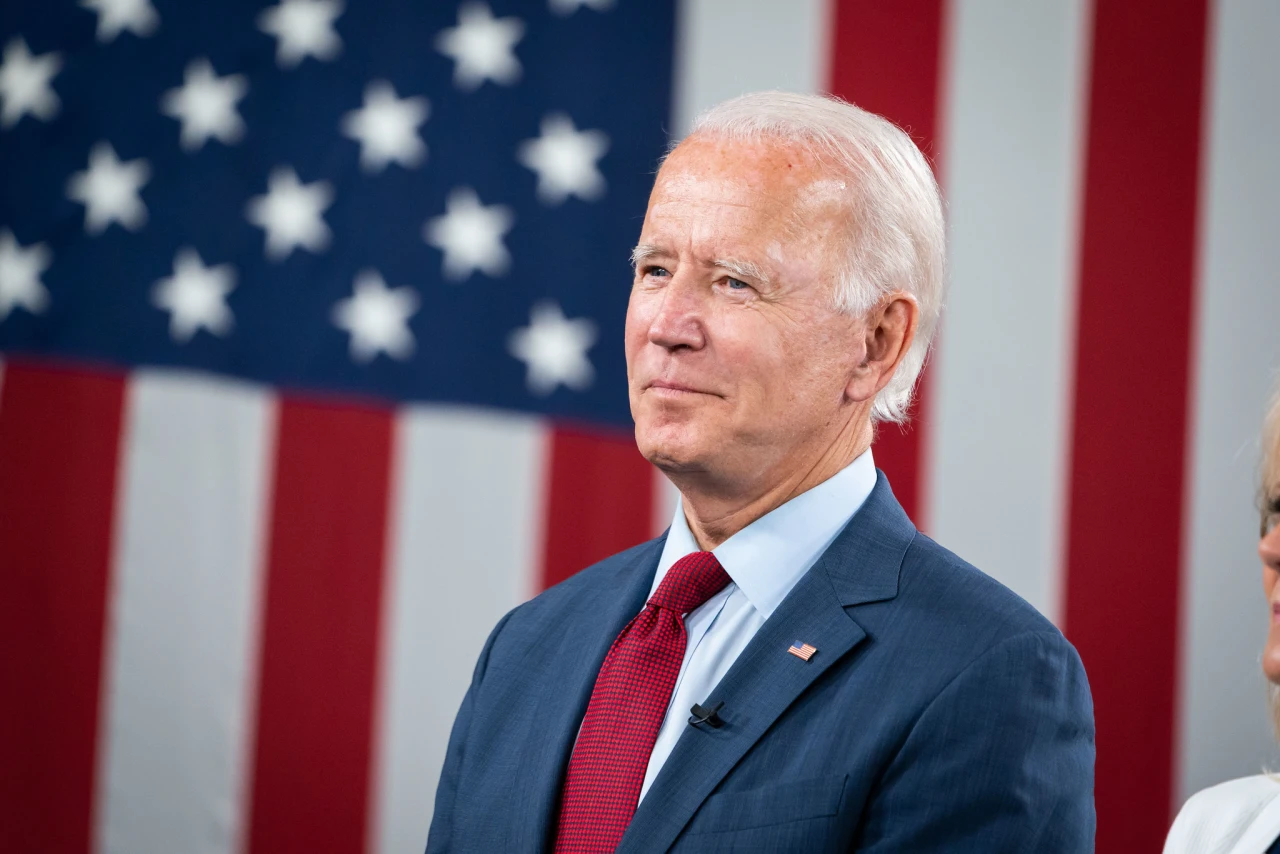

Biden administration does bare minimum in extending pause on federal student loan repayment

On Friday, the Biden administration announced it is extending the pause on federal student loans through Jan. 31, 2022. Federal student loan payments, as well as interest and collections of defaulted loans, had been paused since Congress passed the CARES Act but were set to resume in September. Extending the pause is inarguably a good thing, and as a student debt holder myself, I am glad to see it and grateful for it. But it’s nowhere near enough.

As Daily Kos covered at length, Democrats primaried on student debt relief with a number of perspectives; Sen. Bernie Sanders offered the most sweeping relief vision, while Sen. Elizabeth Warren pledged $50,000 of relief per borrower. Biden, as well as now-Vice President Kamala Harris, were among the most moderate when it came to debt relief. But Biden did still campaign on canceling $10,000 in federal student debt per borrower. We have yet to see it.

But first, let’s look at what the update from the White House actually says. The U.S. Department of Education (DoEd) describes this as the “final” extension on student loans and adds that the “definitive end date” will help borrowers prepare to restart payments and avoid delinquency.

Is a specific date helpful when it comes to managing finances? Sure. But we’re currently surviving a global pandemic in a nation with inconsistent messaging, standards, and protocols for handling a potentially deadly virus. Parents are still trying to figure out child care. Teachers are embracing yet another year of confusing and overwhelming expectations. Hospital workers are taking care of others without having had time to recover from burnout. It’s not that people with debt forget about paying back their loans, or that they don’t have time to get organized; it’s that loans, especially with interest, are too damn high. Especially when so many of us are trying to simply survive.

Thanks to data from a Pew study released in July 2021, for example, we know that two-thirds of borrower respondents said it would be a struggle to resume student loan payments on top of regular bills during the pandemic if the suspension were to end.

If you follow Twitter, you’ve likely noticed a lot of people jumping at the use of the word “final” in the White House statement. Is there a little attitude in that word, “final”? A little get-off-our-backs sentiment when it comes to the push for relief? It’s hard to tell intent, of course, but plenty of people are irked by its usage. On the other hand, some people hope it signals that Biden’s administration will make it clear to what extent he plans to act on loan forgiveness by then. For example, we wouldn’t need another extension if he, say, forgives all federally held student loan debt by January.

But many are worried that’s wishful thinking, especially as we have not heard solid updates on the promise of $10,000 relief. We’ve heard House Speaker Nancy Pelosi dismiss the validity of Biden’s power in federal student debt cancellation just as we’ve heard progressives, like Sens. Chuck Schumer and Elizabeth Warren and Rep. Ayanna Pressley, insist that Biden does, in fact, have the authority to cancel student debt.

“While this temporary relief is welcome,” Schumer, Warren, and Pressley said in a statement in response to the latest repayment extension. “It doesn’t go far enough. Our broken student loan system continues to exacerbate racial wealth gaps and hold back our entire economy.”

Many advocates for debt relief are concerned that trying to pass relief through Congress will be close to impossible, and that if it happens, the amount will be measly due to negotiations. Executive action seems to be the way to go, but Biden himself has expressed hesitance on whether or not he believes he has the actual authority to do so.

From Biden’s actual administration, we’ve heard they’re gathering information on what the president has the explicit legal authority to do. And for us borrowers? In many ways, we’ve had our lives on hold. Carrying student debt makes everything harder, from renting an apartment to buying a house to planning for retirement. That’s especially true for the most marginalized borrowers among us; for example, we know that Black women, on average, hold 22% more student debt than white women borrowers. For bigger picture reference, women hold about two-thirds of all student debt in the U.S.

Data based on 2012 graduates shows that Black students borrowed more student loans than white students to attend public colleges as well as private colleges, and that Latinx and Black students graduated with higher amounts of debt from nonprofit, private colleges than white students did.

While there are options for total student debt relief for borrowers who meet certain specifications for a permanent disability (thanks, Obama!), the process is complex, time-consuming, and, obviously, not inclusive to all people who do live with disabilities. Steps like this help, of course. But it’s not enough until it’s everyone.

And if we’re looking at this issue through a totally pragmatic lens, it’s important to remember that Donald Trump was technically the guy to start the pause on payments, and Biden, as of now, would be the guy to end it. Not a good look, period, and especially not a good look when we think about midterms.