GOP senators hyperventilate over making tax cheats pay up in bid to kill bipartisan deal

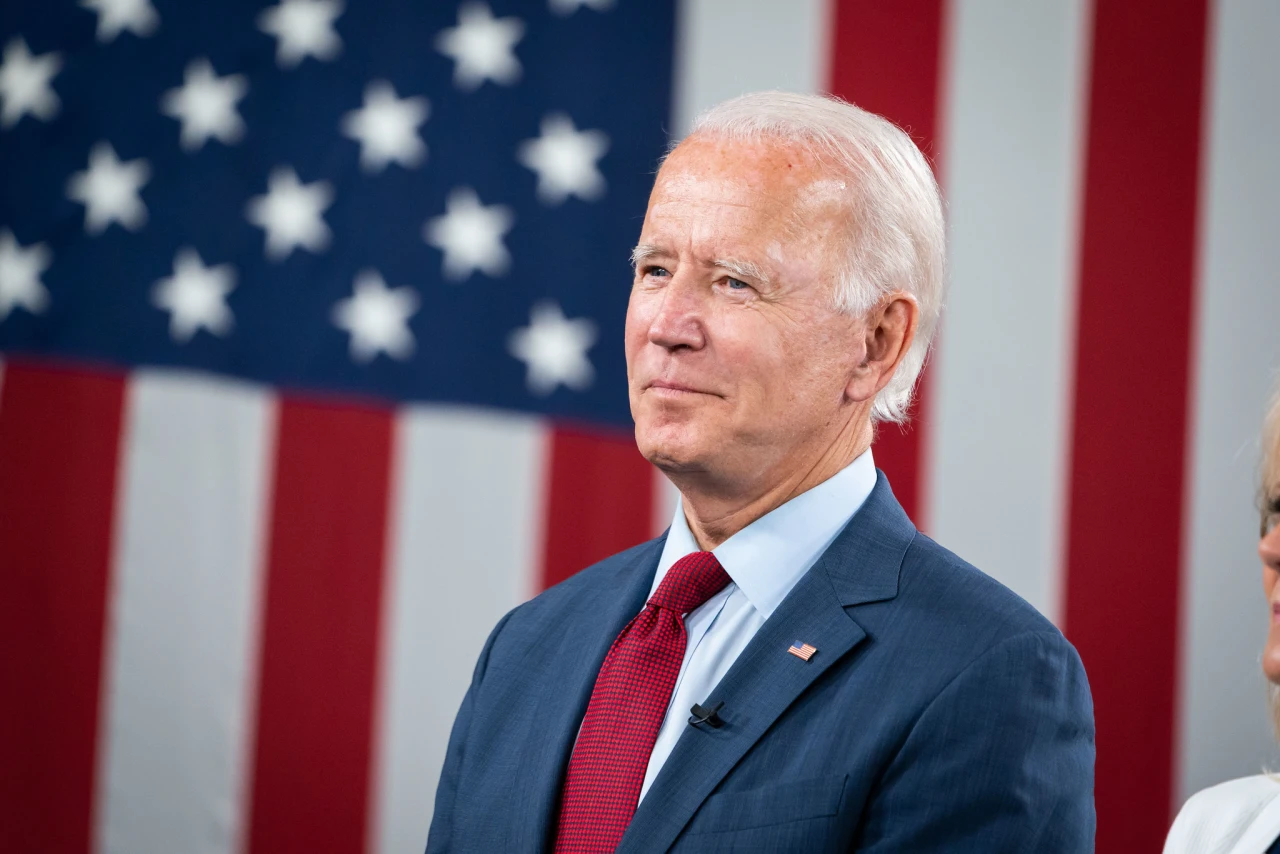

President Joe Biden wants tax cheats to pay the federal government what they owe, an initiative that could bring in an estimated $100 billion in revenues to help fund the trillion-dollar bipartisan infrastructure deal announced last week.

But putting $40 billion into beefing up the IRS enforcement division—as outlined in the $1.2 trillion deal—has Senate Republicans who oppose the deal up in arms. They say equipping the Internal Revenue Service (IRS) to crack down on cheaters is a bridge too far—thereby jeopardizing one of the few actual methods of funding the bipartisan deal that doesn’t involve accounting gimmicks. Apparently, Republicans would rather the deal resort to hardcore deficit spending since they refuse to raise revenues by any other method, such as rolling back their wildly unpopular 2017 tax cuts to the rich and corporate-y. Honestly, it’s getting difficult to take these bozos seriously, but here goes.

“Spending $40 billion to super-size the IRS is very concerning,” Sen. John Barrasso of Wyoming, chair of the GOP conference, told Axios. “Law-abiding Americans deserve better from their government than an army of bureaucrats snooping through their bank statements,” he added.

What Barrasso is objecting to here is training IRS investigators on people and corporations who are deliberately trying to cheat the system (not to mention the American people) and have the resources to do so. Instead, Barrasso would clearly rather just keep the IRS focused on smaller fish, who may have messed up some calculation on TurboTax, for instance. Why? Because the small fries aren’t delivering enough to GOP campaign coffers, that’s why.

“Throwing billions more taxpayer dollars at the IRS will only hurt Americans struggling to recover after waves of devastating lockdowns,” said Sen. Ted Cruz, who voted against Biden’s pandemic relief bill that was specifically designed to help Americans struggling to recover after waves of devastating lockdowns. Oh, and don’t look now, but the economic recovery is exceeding expectations due to federal spending, no thanks to Cruz and every other congressional Republican who voted against the American Rescue Plan.

The backdrop to these GOP objections is the fact that Republicans have spent at least a decade trying to starve the agency into nonexistence, leaving even more avenues for tax evasion. From 2010 to 2018, funding for the IRS fell 20% in inflation-adjusted dollars, resulting in a 22% decline in IRS staff, according to the Washington Post. The enforcement division, in particular, was trimmed by 30% over that decade, with the ranks of those who specialize in complex investigations taking an even bigger hit. Ultimately, that led to a 40% reduction in the number of IRS investigations.

So Republicans haven’t just been trying to kneecap the IRS, they’ve successfully kneecapped the agency to the benefit of their donors.

IRS Commissioner Charles Rettig estimates the agency is missing out on at least $1 trillion in taxes annually in terms of what the federal government is owed.

As Rettig told Congress in April, “We do get outgunned. There’s no other way to say it.”

Republicans want to keep it that way. And for many of them, if that tanks the $1.2 trillion bipartisan infrastructure deal, so much the better.