Democrats can really learn a lot from Republicans about bipartisanship

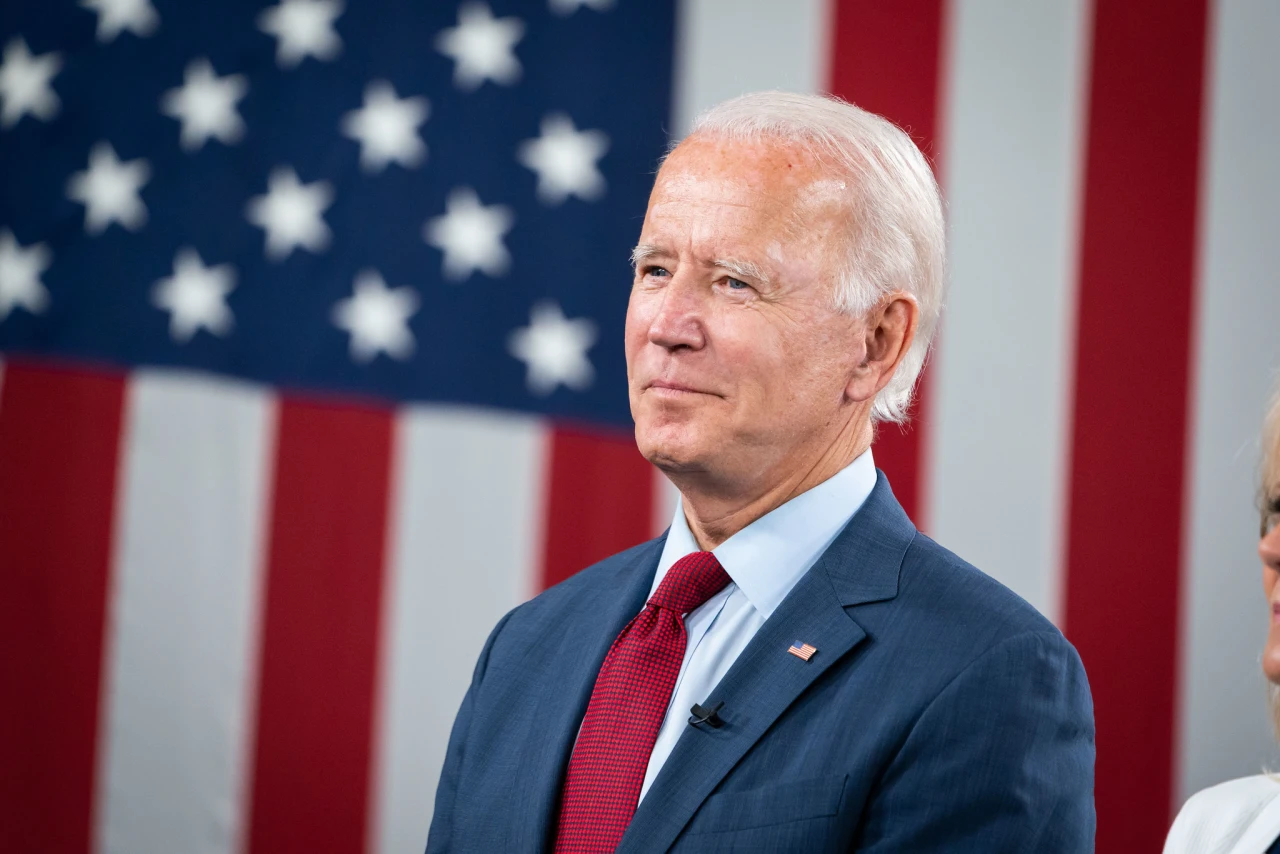

It appears that some Democrats, possibly including President Joe Biden, are once again succumbing to the notion that any legislative measures they take during the potentially very short time they possess a working congressional majority must include at least some semblance of bipartisanship. One would have hoped that after the complete failure in March by any Republican House or Senate members to support the COVID-19 relief legislation, this line of thinking would have been permanently consigned to history, but it seems to have surfaced again, like a perpetually recurring bad dream.

That dream needs to die, and it should have died months ago. This inexplicable search for bipartisan agreement between Democrats and Republicans on President Biden’s vital infrastructure bill suffers from a bizarre lack of recent historical memory.

Republicans’ single legislative achievement during the Trump presidency was the passage of a mammoth tax cut almost entirely designed to benefit a tiny sliver of the American population: the nation’s wealthiest. They did this essentially without any support of ordinary Americans; no one other than corporate CEO’s and the uber-wealthy was clamoring for an upper-class tax cut in 2017.

Not only was the tax cut unasked for, it was unnecessary, serving no common need other than to enrich the coffers of the GOP’s corporate donor base. It did not create any jobs to speak of, nor did it result in such largesse being plowed back into investments or R&D, the way that it was hawked and promoted prior to its passage. Most of the corporate tax cuts ultimately found their way into the pockets of highly compensated corporate officers (primarily in the form of corporate stock buybacks) who simply used it to fatten their already burgeoning stores of generational wealth for themselves and their offspring.

The Republican Party passed this tax cut without any effort to enlist Democratic support. As reported by Time magazine immediately after it passed with no Democratic votes, the entire legislation was an act of wholesale, unbridled partisanship.

Like the president’s current infrastructure bill, the GOP tax legislation was always expected to pass through reconciliation, which would allowed its passage with a simple Senate majority. And Republicans made it clear from the outset that they neither needed or wanted any Democratic input in this process. The Time article describes a supposedly bipartisan dinner on tax policy hosted by Donald Trump and Vice President Mike Pence in September 2017, months prior to the the time of its enactment. Three Democratic senators—Joe Manchin, Heidi Heitkamp, and Joe Donnelly—all representing states Trump had won, were the only invited guests from the Democratic side. One month later, a similar dinner was hosted by Jared Kushner and Ivanka Trump, ostensibly for the same purpose, but switched Missouri’s Claire McCaskill for Joe Donnelly. Sen. Manchin, who attended both of these soirees, later noted that virtually nothing was done to enlist his or any of the other Democrats’ support, even though he said such an effort would have very likely resulted in two or three “easy pickups” for the legislation from the Democratic side.

Nor were Republican efforts to enlist Democrats in the House any more substantial. As reported by The Hill, again immediately after the legislation’s passage, Henry Cuellar, the leader of the House’s conservative “Blue Dog” Democratic caucus, recalled being stunned when after meeting with Kushner and Ivanka Trump, there was no effort whatsoever to accommodate their concerns—not even an opportunity to read the bill before it was filed. As Cuellar put it at the time:

Ultimately the Republican tax bill was rammed through without any substantive hearings, with zero input from either Democrats or the American people, and, as then House Minority Whip Steny Hoyer put it, with “apparently no proofreading.”

Again, it bears repeating that this was a measure that did essentially nothing to directly benefit the vast majority of the American people, did nothing to boost the economy (with the exception of temporarily goosing Wall Street’s markets, the benefits of which are not shared or enjoyed by a majority of Americans), and was passed without any input whatsoever from the party on the other side of the aisle. It was a wholly, unabashedly partisan exercise of power.

Significantly, however, Republicans paid no political price for passing their tax scheme in such a partisan manner, even if they ultimately received no political benefit from it. Hoping to run on its supposed achievements, Republicans were sorely disappointed as the Democrats retook control of the House of Representatives in 2018. Ultimately, Americans’ dim views on cutting taxes for the nation’s wealthiest rendered the GOP’s 2017 tax cut what one commentator characterized as the second-most unpopular piece of legislation over the past 30 years (only GOP attempts to repeal the Affordable Care Act, President Obama’s signature achievement, were less popular). But it was not the ultra-partisan nature of the tax cut that doomed its popularity, but the fact that it did next to nothing to resonate with ordinary Americans.

The Biden infrastructure bill that is currently and tortuously undergoing one bad-faith counterproposal after another from Republicans, is qualitatively far different than the GOP’s 2017 tax legislation. Its provisions will yield literally millions of jobs simply by the nature of the legislation itself. It will vastly improve the lives of all Americans in unmistakable, visible, concrete ways by upgrading and funding our decaying transportation, utility, and energy networks. The legislation will provide Americans throughout the country much-needed access to the internet, home and child care networks, modernized schools, renovated commercial and public buildings, investments in R&D, and job training programs—all real-life benefits to both Republican and Democratic voters alike.

In short, it could not be more fundamentally different than the Republican tax giveaway of 2017. But Democrats would do well to remember one salient lesson about that piece of legislation: There was no angst, no outrage, and no rending of garments by either the media or the American public about the fact that it was wholly partisan. No Republican was ever taken to task by any of their constituents on account of the wholly partisan character of that bill. The fact that it passed without any Democratic support was simply taken as a given by the public. And any political consequences suffered by the GOP because of it were wholly due to the fact that it was an unpopular piece of legislation to begin with, not the fact that it was partisan. If it had actually benefited ordinary Americans, Republicans would be loudly crowing about it to this very day.

And yet, the Biden administration apparently still feels compelled for some unknown reason to seek out and solicit Republican support for its infrastructure bill—support that will never come. The administration—or more to the point, a very few Democratic senators—still vainly seek seek the imprimatur of bipartisan approval from a Republican Party that, by all appearances, is simply hoping to run out the clock until something—anything—happens to eliminate Democrats’ fragile majority. They know that in this hope, time is definitely on their side. So it benefits them to drag along the process as much as humanly possible; there’s a reason, after all, that Senate Minority Leader Mitch McConnell is known as the Grim Reaper.

What the Republicans amply demonstrated in 2017 was that no one—except perhaps a few hyperventilating members of the pundit class—gives a damn whether a given piece of legislation is bipartisan or not. Polls suggesting the American people want Congress to work together completely miss the point; Americans have clearly demonstrated that whatever they say they want, ultimately they don’t care as long as it gets done. The only thing that matters to Americans is the impact it has on their lives, for good or for bad.