Inflation didn't matter when Trump cut millionaires' taxes, but now that a Democrat's president…

Inflation is defined as the rate at which prices for goods and services are rising. It’s a serious issue that has a real impact on people’s lives. Too big or quick a rise disproportionately harms the economically vulnerable, who find themselves unable to pay the rent or buy food.

Republicans, however, are using the fear of inflation in an unserious, yet dangerous way. They are lying by brandishing it as a weapon against the Biden-Harris administration’s plans to invest in American jobs and American families.

To say that Republicans have had a hard time making a coherent case against Biden’s progressive economic proposals is an understatement the size of the twice impeached former president’s upcoming debt obligations.

Earlier this year, when Republicans attacked the $1.9 trillion American Rescue Plan (ARP) that passed Congress without a single vote from their caucus, they said it would push the economy into overdrive and cause significant inflation. Pennsylvania Sen. Pat Toomey, for example, criticized the COVID-19 relief package in late February on these grounds: “There are a lot of warning signs that have not been worrisome in the past but now are certainly blinking yellow. At some point, we’ve got too much liquidity going into the system. The economy is recovering very, very well.” Not one very, but two, mind you. Likewise, in March South Dakota Sen. John Thune intoned that Biden’s spending plans would “unleash inflation,” while Florida Sen. Rick Scott thundered about an inflation-induced “day of reckoning.” Frightening indeed.

Yet, on the other hand, the recently proposed American Jobs Plan and American Families Plan—which would spend $4 trillion over ten years, and pay for it by making the wealthiest individuals and corporations pay their fair share of taxes—are bad ideas according to Republicans because, wait for it, the economy is too weak, even after the ARP’s passage. Here’s Missouri Rep. Ann Wagner: “Why, as this country begins to reopen and recover economically, would the Biden administration be proposing tax policy which would in the end hurt the American family and millions of struggling small businesses?”

When an article in The Hill, about as straightforward a source on national politics as there is, makes fun of your head-spinning political spin, that’s not a good sign. Even if we were to take this ridiculousness seriously, the notion that a plan that’s revenue neutral over the long term, and actually spends more than it takes in right now would harm rather than stimulate the economy in the short term is dumb—even for the Party of Texas Rep. Louie Gohmert.

In recent days the Republicans have gone back to bleating about the dangers of inflation if Biden’s plans become law. After the 46th president laid them out in detail in his address to Congress last Wednesday, Maine Sen. Susan Collins—whose reactions are in no way predictable—expressed grave concern: “I worry that it would ignite inflation, which is very harmful to our economy.” Tennessee Sen. Marsha Blackburn made a similar prediction, and added: “the wallets of Americans from every walk of life are hurt by Biden’s tax plan.” That’s simply incorrect, as Daily Kos’s Dartagnan laid out in a recent post contrasting who will benefit from the Biden plan (the 99%) as compared to Trump’s policies (the Trump family and assorted other richies).

On a related note, when not fearmongering about Biden’s proposals and inflation specifically, Republicans just resort to lying about the plan itself, as Louisiana Sen. John Cassidy did on Meet the Press this past Sunday. The president’s plans total $6 trillion—not $7 trillion, as Cassidy said, but that’s only the smaller of the lies he told. The senator also condemned “the $7 trillion in spending the administration has proposed for this year alone,” expressing concern about the deficit. The American Rescue Plan spends most of its money this year (it is a COVID relief package, after all), but the American Jobs Plan and American Families Plan spread out their spending over a decade. Cassidy said all the money (plus the nonexistent trillion he tacked on) would be spent in one year, and liked the lie so much he repeated it twice in 30 seconds. For those optimists hoping that host Chuck Todd caught the lie and questioned Cassidy, I’m sorry to disappoint you.

Here’s the thing: this whole Republican “concern” about inflation—or budget deficits, for that matter—is, as defined by professional economists, little more than bullshit. For example, Paul Krugman is a Nobel Prize-winning economist. He’s been calling out the right-wing’s faux hand-wringing about inflation for a dozen years. Do you remember when conservatives slammed President Obama’s 2009 stimulus package, and the subsequent proposals he made for additional investments because they would cause inflation? Here’s Krugman writing in December 2010: “For two years we’ve been warned that inflation, even hyperinflation, was just around the corner; instead, disinflation has continued, with core inflation—which excludes volatile food and energy prices—now at a half-century low.” Inflation has remained low in the years since—sitting for a decade right around or under the Federal Reserve’s 2% annual target.

The only thing that does change is the timing of when Republicans start pretending to worry about inflation—namely, whenever Democrats are proposing to spend money on regular people. Notice that when their party was in the White House and getting the credit, spending trillions wasn’t a problem at all (see CARES Act, The). Eric Levitz, in New York magazine, characterized conservatives who spent like drunken sailors while the Insurrectionist-in-Chief sat in the Oval Office and then started wagging their fingers about fiscal responsibility as follows: “the Republican position here is roughly akin to that of a cannibal who gobbles up toddlers by the dozen each weekend, then dutifully observes “meatless Mondays,” so as to safeguard his credibility as a vegan.”

The same partisan-centric timing, by the way, defines Republicans’ predictably inconsistent deficit peacockery. When Trump passed his Rich Man’s Tax Cut in late 2017, at a time when the economy was already running at basically full steam thanks to the boom he inherited from his predecessor, President Obama, we heard nary a peep from conservatives about its potentially inflationary impact. Federal Reserve officials, however, warned about just that in the months prior to the tax giveaway’s passage, but the Trumpists took that warning as seriously as they do the threat of climate change. The point is this, Republicans don’t really care about inflation. One positive from all these years of whiplash we’ve gotten from their constant reversals is that even the “both sides are the same” media might finally be catching on.

Nevertheless, there are signs that prices are rising right now. Famed investor Warren Buffett recently told shareholders in his company, Berkshire Hathaway: “We are seeing substantial inflation. We are raising prices. People are raising prices to us, and it’s being accepted.”

Republicans may be completely insincere when they talk about inflation, but we in the reality-based community actually want to understand what’s happening. We take facts seriously, and incorporate them into our thinking when developing policy. There are centrist Democrats like former Obama and Clinton top official Lawrence Summers also talking about inflation possibly being stoked by the Biden proposals. On the other hand, Austan Goolsbee, another Obama alum who is not serving in the Biden White House, pushed back against those concerns. At least on the Democratic side it’s an honest debate.

Furthermore, as per Daniel Alpert, senior fellow in finance and macroeconomics and an adjunct professor at Cornell Law School, the financial markets do not expect Biden’s plans to spark inflation: “Just look at the mechanics: Demand for interest-bearing Treasury bonds—safe assets that are issued whenever the government creates more debt—remains very high, meaning that interest rates are near historic lows and inflation expectations are mild. For now, there’s no hint of the currency debasement feared by inflation hawks.” There’s a lot of jargon in there, but I’ve bolded the key part for those who want to cut to the chase.

Okay, but why are prices rising at this moment, and could it mean that—like a stopped clock that’s right twice a day—Republicans are actually correct that Biden’s plans are a bad idea right now? The answer is no, and let’s explore why that is.

There are multiple reasons why prices are rising. One is that, for now at least, they are rising off artificially low levels. Prices dropped severely last spring when large parts of the economy shut down due to COVID-19. The government measures inflation based on where prices stand in the present compared to where they were a year ago. A big drop a year ago followed by a return to where things were before the drop registers as a huge increase today, but in reality all it means is that we’re back to the level of a year ago. This is known as the “base effect.”

We’re also seeing price increases because of pent-up demand. People weren’t spending for a long time because they were afraid to, given job losses thanks to the pandemic. Now, with hiring on the mend and the sizable stimulus checks people received from Biden’s American Rescue Plan, they are spending again. All that demand means companies are having a hard time keeping up—and thus they are charging more for what they sell.

Additionally, there’s another reason for these climbing prices, and this one is very much on the economic policies of The Man Who Lost An Election And Then Tried To Steal It. Currently, there are significant disruptions in the supply chain, which refers to the ”series of steps involved to get a product or service to the customer.” For example, if a company can’t make a complex product—like a car—because one of its components is in short supply, then that means the supply chain is delaying things.

When that happens, companies start paying more for the component(s) they can’t get enough of, and thus the final product’s price goes up as well. As the New York Times explained, there’s one thing making this whole problem a lot worse than it otherwise would be: “Intensifying the supply chain problems are hefty tariffs that Mr. Trump imposed on Chinese imports, along with steel and aluminum from Europe and other parts of the world.” Simply getting rid of Trump’s tariffs isn’t so easy for Biden, however, given that they were implemented during a trade dispute, thus a unilateral surrender could be seen as a sign of weakness. Either way, Biden’s plans to invest in infrastructure and the care economy will have nothing to do with inflation being caused by Trump’s tariffs.

It’s important to note that the White House is very much paying attention to inflation, and has been for a while now, as the New York Times reported in April. Even before President Biden took office, some of his closest aides were focused on a question that risked derailing his economic agenda: Would his plans for a $1.9 trillion economic rescue package and additional government spending overheat the economy and fuel runaway inflation?

To find the answer, a close circle of advisers now working at the White House and the Treasury Department projected the behaviors of shoppers, employers, stock traders and others if Mr. Biden’s plans succeeded. Officials as senior as Janet L. Yellen, the Treasury secretary, pored over the analyses in video calls and in-person meetings, looking for any hint that Mr. Biden’s plans could generate sustained price increases that could hamstring family budgets. It never appeared.

Those efforts convinced Mr. Biden’s team that there is little risk of inflation spiraling out of the Federal Reserve’s control.

The White House put out a memo in that same month, written by top economic advisers Jared Bernstein and Ernie Tedeschi, which laid out its thinking: “We think the likeliest outlook over the next several months is for inflation to rise modestly … and to fade back to a lower pace thereafter as actual inflation begins to run more in line with longer-run expectations.”

Sec. Yellen has spoken out as well recently on the matter of potential inflation. On Meet the Press Sunday, May 2, she discussed the American Families Plan and American Jobs Plan with the aforementioned Mr. Todd, stating: “I don’t believe that inflation will be an issue but if it becomes an issue, we have tools to address it. These are historic investments that we need to make our economy productive and fair.” This is an important point—if prices rise, the government does not become suddenly helpless. Plus, these are necessary investments. Doing nothing is not an option.

On Tuesday, Yellen caused a stir in the markets when she predicted that “very modest” interest rate increases might end up occurring, but then clarified later in the day that an increase in rates was “not something I’m predicting or recommending,” and added that she did not envision there was “going to be an inflationary problem.”

Conservative pundits like Washington Post columnist Henry Olsen pounced on Yellen’s comments, using them to attack Biden’s investment plans. “The signs of looming inflation are all around us,” he all but shouted to the rooftops. The signs were always looming in 2009-10 too, but the inflation never actually arrived. Investors made clear what they glimpse on the horizon, and it’s not inflation: a month ago, investors were seeing a 15% likelihood that the Fed would raise interest rates by the end of 2021. On Friday, after the monthly jobs report was published, the likelihood had fallen to 7%.

The aforementioned Krugman ripped the “hair-trigger media response” to Yellen’s initial comments, and explained that what she said only caused a stir because commentators were acting like schmucks—to use another academic term. For anyone who wants to go full economist, Krugman also put out an even wonkier analysis of why inflation is under control right now, and why fears of future inflation are not a legitimate reason to criticize Biden’s plans.

The White House, as well as Federal Reserve Chair Jerome Powell, believe that the price increases occurring right now will not require the Fed to hike interest rates in a major way and thus slow down the economy in order to tamp down inflation. As Powell stated in January when talking in general terms about bold government action, we need to think big: “I’m much more worried about falling short of a complete recovery and losing people’s careers and lives that they built because they don’t get back to work in time.” He added: “I’m more concerned about that and the damage that will do, not just to their lives but to the United States economy.” Last Wednesday a number of top Fed officials and policymakers made public statements emphasizing that they and Powell are on the same page regarding the temporary nature of recent jumps in prices.

Inflation absolutely can hurt people. In the 1970s and early ‘80s, high inflation in the U.S. meant that people on fixed incomes had real trouble making ends meet as prices rose and their incomes stagnated. But what can also hurt is not fixing real problems. When one party disingenuously seeks to exacerbate anxiety about inflation as a reason never to take action to help large numbers of Americans, we need to recognize and call out those zombie lies for what they are.

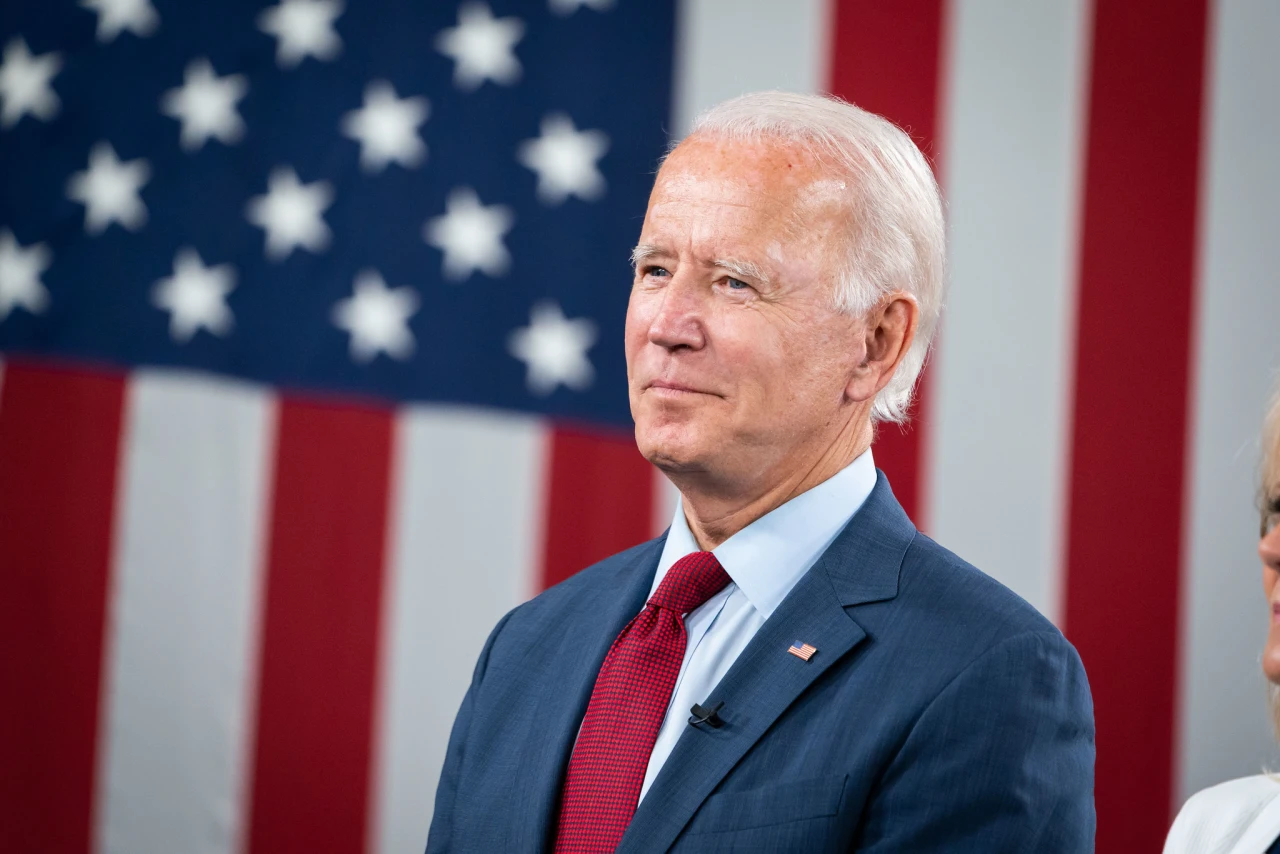

At the end of the day, Joe Biden, Kamala Harris, and the Democrats are aiming to do big and necessary things for the American people, while Republicans are always the party of no—unless we’re talking about tax cuts for the rich. In that case the fear of inflation or deficits or whatever other boogeyman they’ve been screaming about just conveniently fades into the background.

Ian Reifowitz is the author of The Tribalization of Politics: How Rush Limbaugh’s Race-Baiting Rhetoric on the Obama Presidency Paved the Way for Trump (Foreword by Markos Moulitsas)

Friday, May 14, 2021 · 3:11:17 PM +00:00 · Ian Reifowitz

On Wednesday, the Labor Department released April’s Consumer Price Index report, and the increase in prices came in above expectations, further confirming the trend. However, Fed Vice Chair Richard H. Clarida warned against overreacting, and noted “this is one data point.” See also Krugman’s Friday NYT column, where he dives deep into the report and offers the following conclusion: “Does it look like something to worry about? No, not really.”